ISSB Issues Inaugural Corporate Reporting Standards; Sets a New Milestone

On June 23rd, the International Sustainability Standards Board (ISSB) announced its inaugural corporate reporting standards for sustainability and climate risk. The publication followed a consultation process that lasted more than 18 months and garnered many responses from stakeholders. For the first time, the Standards create a universal framework for disclosing the impact of climate-related risks and opportunities. This milestone marks a significant step forward in promoting transparent and accountable corporate sustainability practices worldwide. Click below the picture.

EDITOR’S NOTE: TBG Purpose is a leading sustainability partner for corporations, institutions and governments. TBG Purpose provides an integrated set of solutions and enables organizations to meet their Sustainability/ESG objectives in line with global reporting standards and frameworks. Contact our team for a free Sustainability Assessment and get out your TruePurpose Score.

Emmanuel Faber, ISSB Chair, said:

“Today represents the outcome of more than 18 months of intense work to deliver an inaugural set of sustainability disclosure standards for the global capital markets. The ISSB Standards have been designed to help companies tell their sustainability story in a robust, comparable and verifiable manner. We have consulted closely with the market to ensure the Standards are proportionate and will result in disclosures that are relevant for investment decision-making.”

Key Components of the ISSB's Inaugural Reporting Standards

The ISSB Standards are divided into two reporting tiers, IFRS S1 and IFRS S2, with both becoming effective on January 1, 2024.

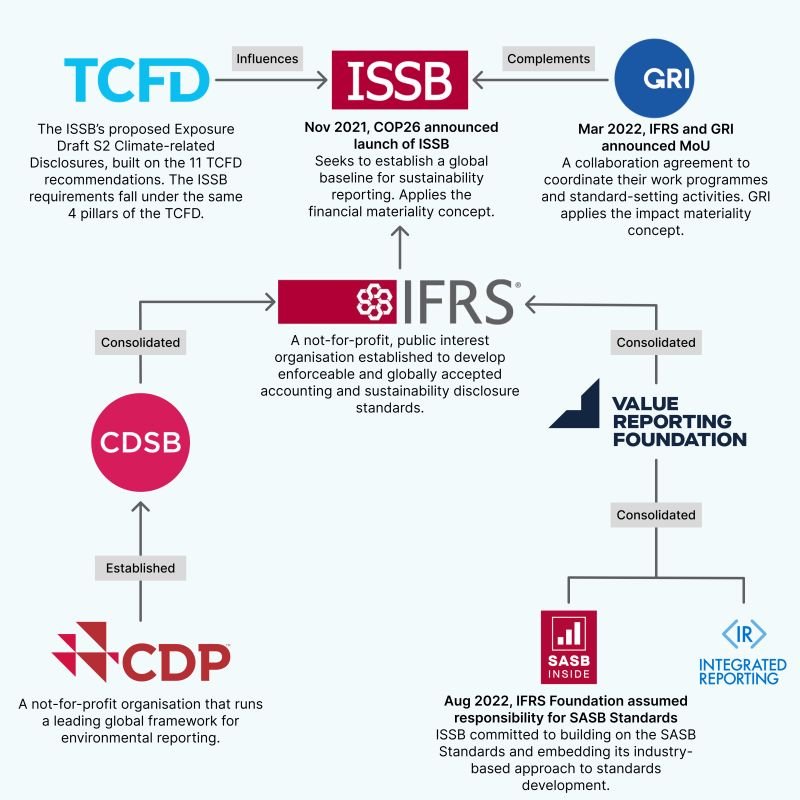

IFRS S1 (S1) refers to general requirements for disclosure of sustainability-related financial information. It provides a set of disclosure requirements designed to enable companies to communicate to investors about the sustainability-related risks and opportunities they face over the short, medium and long term. IFRS S2 (S2) sets out specific climate-related disclosures and is designed to be used with IFRS S1. Both fully incorporate the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

According to Bloomberg News, here’s what S1 will require companies to do:

Disclose information material to financial prospects, i.e. information that may “influence decisions that primary users of general purpose financial reports make.”

Explain risk management approach to identifying, monitoring sustainability-related risks.

Disclose governance processes in place to monitor risks.

Here’s what the S2 will require companies to do:

Measure greenhouse gas emissions in accordance with the Greenhouse Gas Protocol unless required to use alternative measure, including Scopes 1, 2 and 3.

State the amount and percentage of assets or business activities that are vulnerable to climate-related transition and physical risks.

Disclose the amount of capital expenditure, financing or investment deployed towards climate-related risks and opportunities.

Explain whether and how internal carbon pricing is used.

Describe climate-related targets and whether and how climate-related considerations factor into executive remuneration.

Benefits of Implementing ISSB Standards

A survey conducted by Morgan Stanley in 2021 found that 88% of millennial investors - the largest growing new investor group - are interested in climate-themed investments, compared with 74% of all investors. As more investors consider sustainability in their decision-making, the demand for transparent and standardized sustainability information is becoming increasingly significant.

In recent years, publicly traded companies have increasingly incorporated Environmental, Social, and Governance (ESG) reports into their annual financial statements. The content of these reports varies, reflecting the specific priorities of corporate executives. But for investors, reports from different companies are difficult to compare, making it harder for them to make informed investment decisions based on a company's ESG performance. The adoption of the ISSB Standards can enhance the consistency and comparability of this reporting. Investors will benefit from having a clearer understanding of a company's sustainability performance and its potential risks and opportunities related to climate and environmental factors. This newfound transparency will empower investors to make more informed investment decisions, aligning their portfolios with their sustainability values and objectives.

For companies, using IFRS S1 and S2 simultaneously enables companies to provide both sustainability-related information and financial statements in the same report. Moreover, the ISSB standards have been developed to be used in conjunction with any accounting requirements. They are also built on the concepts that underpin the IFRS Accounting Standards, which are required by more than 140 jurisdictions. The ISSB Standards are suitable for application around the world, creating a truly global baseline.

Klaus Schwab, Founder and Executive Chairman, World Economic Forum, said:

“The publication of the first two ISSB Standards represents a vital step forward in establishing a global baseline for sustainability reporting. Consistent and comparable sustainability information, paired with financial information, empowers investors and stakeholders to gain a comprehensive understanding of a company’s performance and their commitment to driving sustainable value creation. We look forward to our continued collaboration.”

Adoption of the ISSB Standards

According to WSJ Sustainable Business, It is now up to individual countries and jurisdictions to decide if and when they will adopt the ISSB standards. Reporting could start as early as 2025. So far, major countries that have indicated they are setting up mechanisms to consider using the ISSB standards are Australia, Canada, Japan, Hong Kong, Malaysia, New Zealand, Nigeria, Singapore and the U.K.

Despite the strong demand for one standard, U.S. and European Union officials are each developing their own climate reporting regimes. The ISSB has worked closely with American, European, Japanese and Chinese officials, together with the International Organization of Securities Commissions, or Iosco, to develop its rules as a global baseline and work on interoperability between jurisdictions, but some gaps are expected to remain. The still-to-be-finalized SEC climate disclosure rules are expected to take a lighter touch than the ISSB. EU rules require more disclosure, particularly for stakeholders beyond investors.

Future Actions

Now that S1 and S2 standards have been issued, the ISSB will work with jurisdictions and companies to support adoption. The first steps will be creating a Transition Implementation Group to support companies that apply the standards and launching capacity-building initiatives to support effective implementation.

The ISSB will also continue to work with jurisdictions wishing to require incremental disclosures beyond the global baseline and with GRI to support efficient and effective reporting when the ISSB standards are applied in combination with other reporting standards and frameworks.

Additionally, the ISSB will take over the responsibilities of the TCFD starting from next year. This shift comes in response to a formal request made by the Financial Stability Board (FSB). The transition of responsibilities from TCFD to the ISSB signifies a notable change in the landscape of climate and sustainability disclosure. This change offers a glimpse into the proactive steps being taken towards unified sustainability reporting. Furthermore, it highlights the rising influence of the ISSB since its global standards for sustainability and climate reporting were issued.

Mary Schapiro, Head of the Task Force on Climate-related Financial Disclosures (TCFD) Secretariat and Vice Chair for Global Public Policy at Bloomberg L.P., said:

“The global economy needs common reporting standards to reduce fragmentation and drive comparability in climate-related financial data. Built upon the foundation of the TCFD framework, the ISSB Standards provide a global baseline for companies to disclose decision-useful, climate-related financial information—information that is critical for creating more transparent markets, helping achieve a smooth low-carbon transition, and building a more resilient and sustainable global economy.”

Source: AuditBoard